21. December 2023 By Nicole Zieger and Jonas Abel

Why change management is critical to whether or not an AI initiative succeeds

With all the hype currently surrounding generative AI (GenAI), people are divided into two main camps, namely those who support it and those who remain sceptical. There are considerable risks when it comes to the critical, complex processes found at the insurance industry because the two sides are so far apart in their respective opinions. The proponents of GenAI tend to use the technology blindly and without constraint, which can lead to security risks and misuse, whereas the sceptics are apt to stand in the way of innovation and thwart any potential competitive advantage that may be gained from its use.

This blog post provides a short overview on how GenAI can drive innovation in the insurance sector and why effective change management is important for both its sceptics and proponents.

GenAI as an opportunity for insurance companies

The use of GenAI can lead to massive gains in efficiency in the insurance industry, particularly in areas such as claims settlement and underwriting. If a company wishes to adopt this technology, they need to have a carefully defined change management strategy that creates structure, raises awareness and reduces the anxiety associated with its use. This is essential in order to avoid both uncontrolled use by its proponents and innovation from being blocked by its sceptics.

Traditional processes – are they something to build on or do they stand in the way?

This is a watershed moment for the insurance industry. The use of solutions based on AI (artificial intelligence) has the potential to revolutionise the sector. This can be built on traditional processes, though they will need to be adapted to the innovative uses of generative AI. While making these changes has the potential to significantly boost efficiency, they also entail adjustments for employees that require targeted change management. The successful implementation of AI requires technological expertise as well as a willingness to change across all levels of the organisation.

Old, outdated processes not only stand in the way of innovation, they are often also the cause of complex regulatory requirements, silo thinking, departmental barriers and a risk-averse corporate culture. AI technologies create a hybrid model that increases efficiency and customer satisfaction by being mated with traditional processes. To give an example, generative AI can automatically create personalised insurance policies by analysing personal data and risk profiles, which reduces the time needed to conclude policies and creates personalised customer experiences.

The use of AI represents a major change for employees

The integration of AI represents a significant change for employees. Professional change management is vital in order to change how people think and bring the organisation into the AI era. Employees pass through the necessary phases from initial fear to acceptance through targeted change management. They make decisions, develop skills and start to enjoy the human-machine interaction.

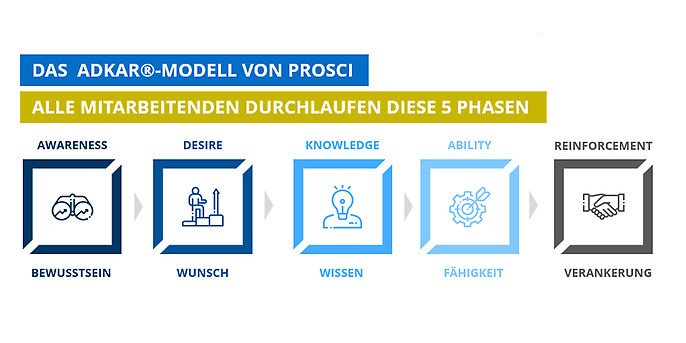

Targeted change management measures based on the five phases of change (ADKAR)

The Prosci ADKAR model

- A – Awareness: We first need to explain to all employees how, when and why things will change and who will be affect by this before we deploy AI in our daily work routine. Having a strong vision (supported by company management) and communication plans is critical here. As multipliers, managers play a key role in getting the message out there, since they work closely together with staff. We recommend that you set up a special body (an AI committee, for instance) that represents the interests of various stakeholders. It is really important that management work hard to present the use case for AI in ‘automated’ claims processing, in which many steps in the review process are transferred from employees over to AI. One way to do this would be to focus on the fact that AI is a tool that employees can work with to make workflows more efficient and increase the overall competitiveness of the insurance company.

- D – Desire: It is important, from a change management perspective, to recognise the fears and concerns that employees may have and to stress that AI supports rather than replaces them. You should explain the specific added value that AI delivers as well as the gains in performance at a company and employee level. AI speeds up simple standard cases, frees up more time for more complex ones and improves communication with customers. This in turn increases the quality of the results and makes work more interesting. You can create trust and peace of mind if you clearly communicate the ethical regulations that impose limits on AI and protect employees. Beyond management, companies should also designate change agents who provide information, give a voice to employees’ concerns and pass on their ideas and feedback.

- K – Knowledge: One-on-one talks and other special workshop formats should be used to get across how responsibilities and processes will change due to AI and define what tasks will be performed by employees and which ones by AI. It is crucial to provide clear, transparent information on responsibilities and contact persons. Joint agreements between employees and managers can be used to promote acceptance. Change management helps an employee understand his or her role and identify the skills necessary to perform this role. Information sessions on the topic of ‘AI in an industry context’ are a good way to keep employees up to date. Workflow and responsibilities change following the rollout of an AI solution for automated claims processing. Having clear information on how the artificial intelligence-based solution works increases employees’ trust in their new ‘AI’ colleague.

- A – Ability: Employees can learn about the changes to workflow and how AI is integrated into them through hands-on training. Being involved in the test phases and having access to the safe space of the training room enable employees to gain initial experience. Along with that, case studies and exercises show how reliable AI is. Having a proper understanding of generative AI and knowing how to use it correctly are absolutely essential. The transition over to complex test cases increases the demands placed on employees. Alongside AI training, AI-based knowledge systems on standard rates or compliance guidelines can close any gaps in their knowledge.

- R – Reinforcement: We recommend starting a pilot project at the beginning of the process, converting the findings into lessons learnt and scaling them up. Regular feedback loops with employees reveal areas where they lack the necessary information and help optimise the use of AI. There are no guarantees that the new mindset will take hold or that the integration of AI will succeed. A good way to increase motivation amongst staff is to show gratitude and appreciation, celebrate successes and establish roles. By introducing an AI solution for automated claims processing, process mining solutions can help draw attention to process-related improvements. To give two examples, AI significantly increases the number of claims processed and the quality of the decisions made.

Change management as a critical factor in the success of AI

The future of the insurance industry depends on its ability to adapt to technological innovation and effectively make use of these new technologies. Traditional processes provide a solid foundation from which to start, though they can also stand in the way of innovation. The integration of AI solutions is an opportunity to reshape the industry while also retaining proven expertise. Targeted change management can build a bridge between established processes and the potential offered by AI.

However, acceptance for and the successful use of AI require a comprehensive change in corporate culture and targeted support for employees throughout all phases of the change process.

It is necessary to take a holistic, proactive approach in order for the insurance industry to capitalise on the opportunities presented by this technological revolution and enter on a path of future success.

Would you like to learn more about exciting topics from the world of adesso? Then check out our latest blog posts.

Also interesting: